maryland student loan tax credit status

There isnt a set amount thats. Web The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

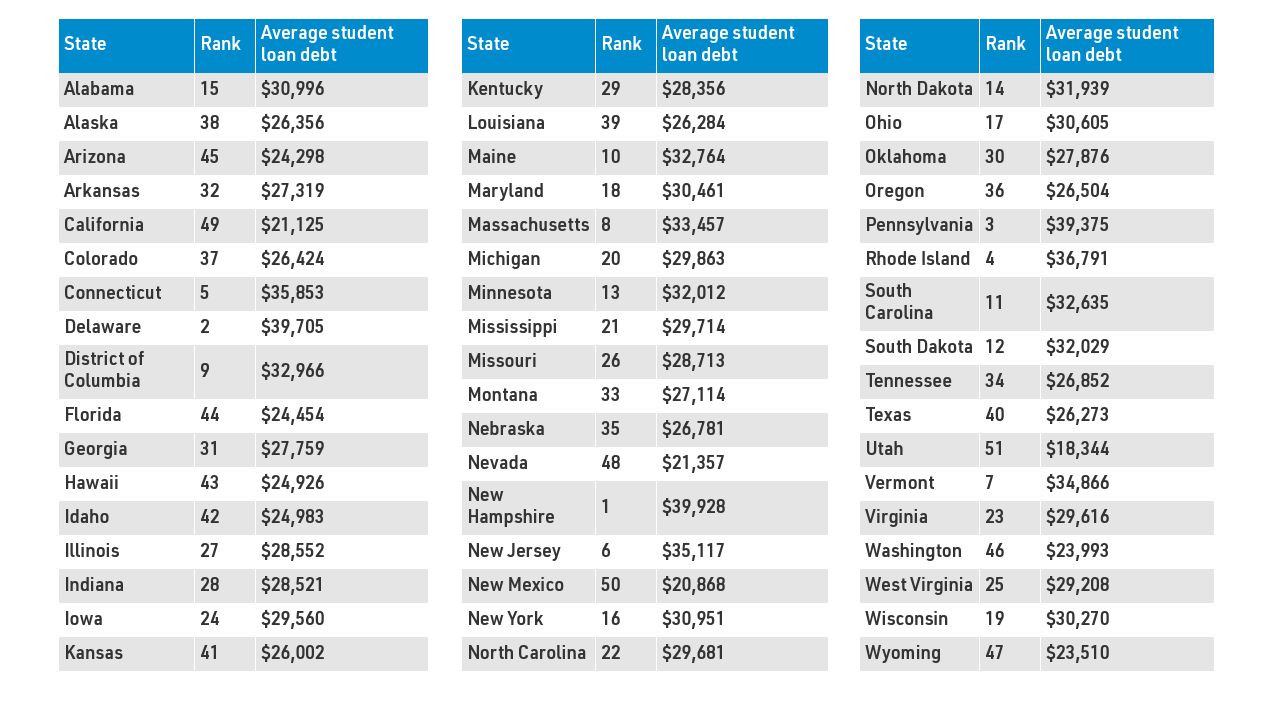

This Is The Average Student Loan Debt In Every State Fox Business

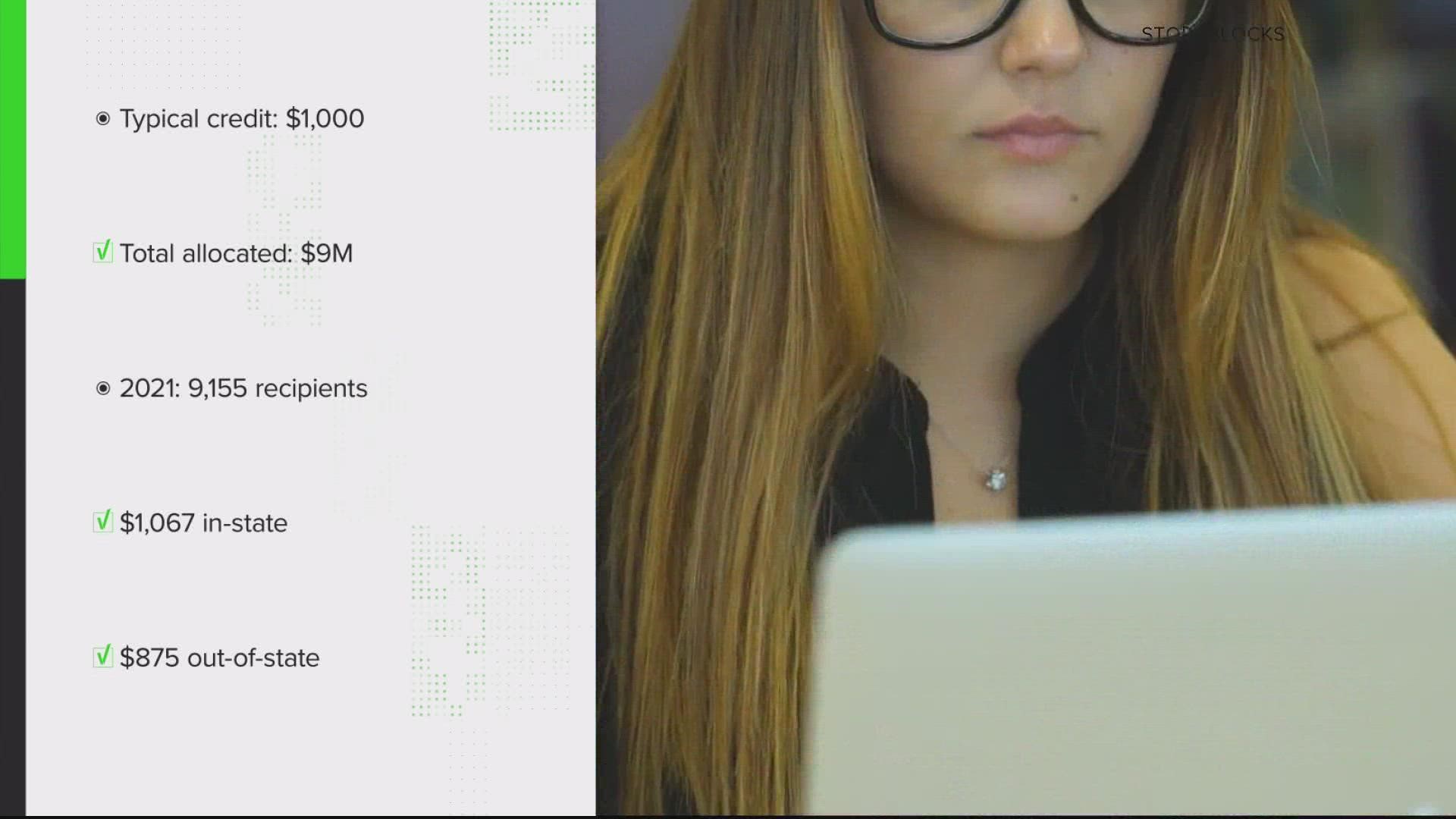

With more than 40 million distributed through.

. Web The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax. Web On Aug. Web The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. Web to repay the credit. If you receive student loan.

Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain. Web Maryland Income Tax Calculator 2021. Web Status In the House - Hearing 128 at 130 pm.

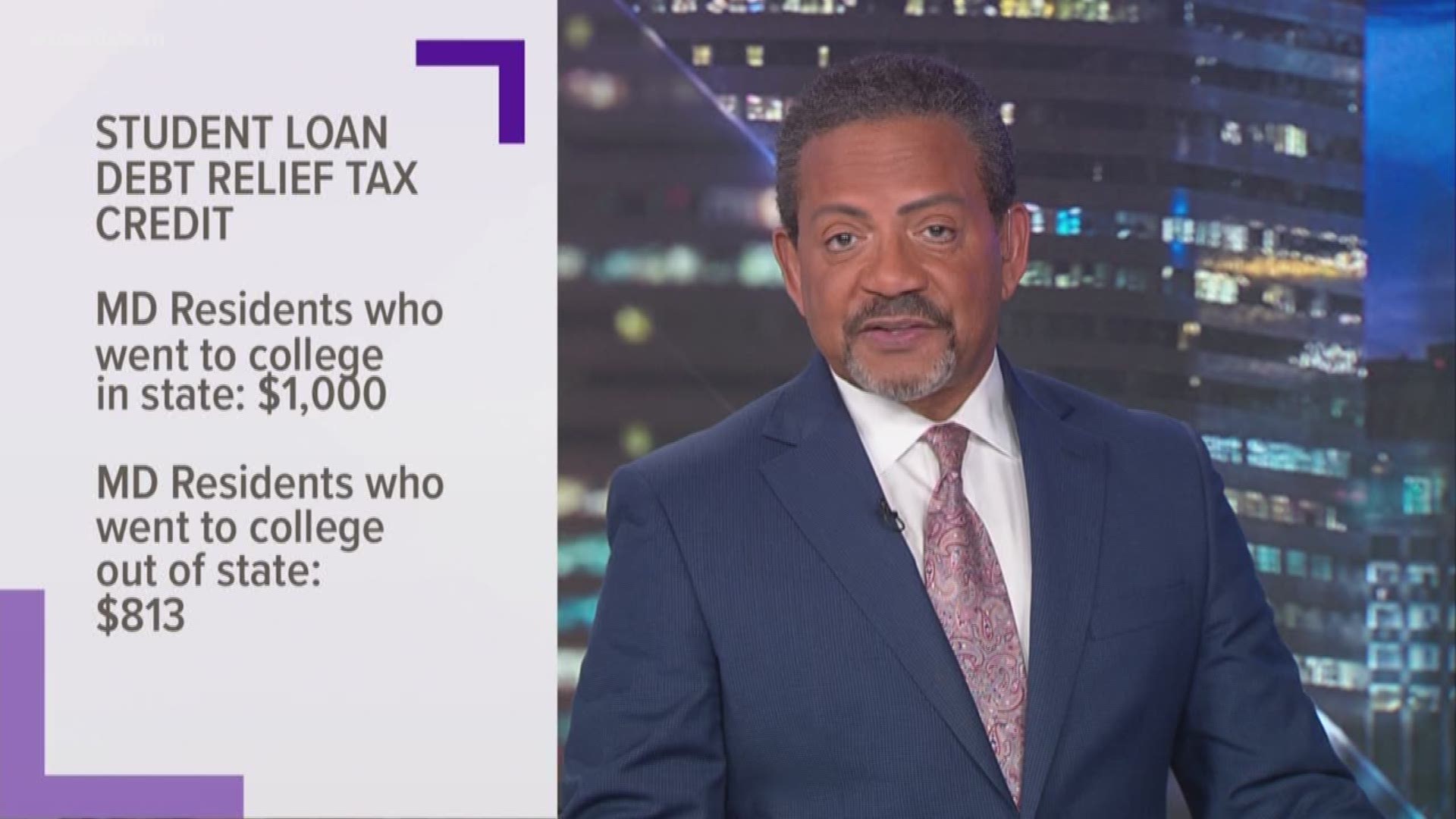

From the last three years the state of the United States of America has. Web Mississippi has a graduated income tax rate ranging from 3 to 5 and Minnesotas graduated tax rate spans from 535 to 985. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

The credits goal is to aid residents of the Chesapeake Bay. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of. Web who wish to claim the Student Loan Debt Relief Tax Credit.

Web For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. If you make 400000 a year living in the region of Maryland USA you will be taxed 132835. Incurred at least 20000 in total.

Web To qualify for the Student Loan Debt Relief Tax Credit you must. Web Student Loan Debt Relief Tax Credit. Web This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax.

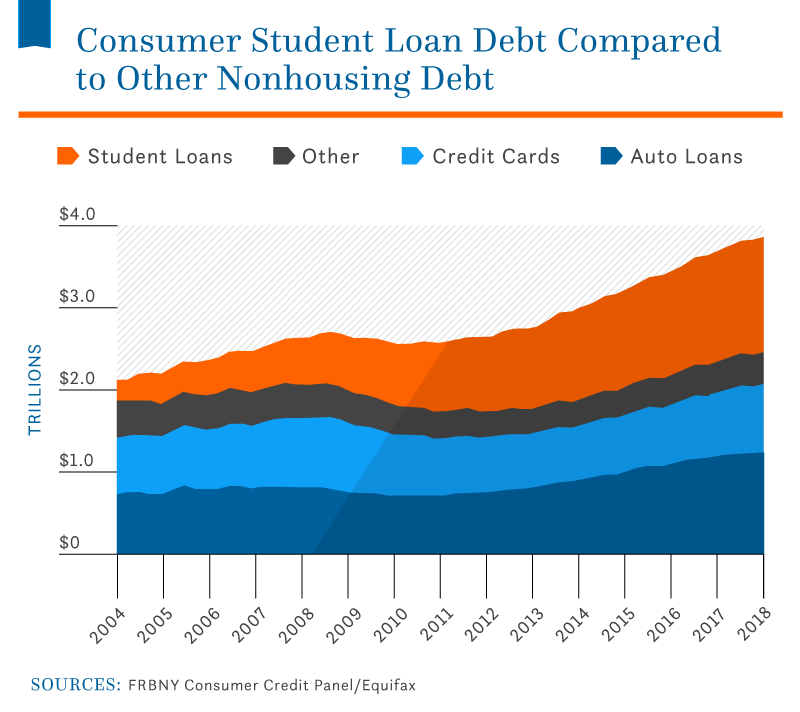

With more than 40. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017.

Web The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education. File Maryland State Income Taxes for the 2019 year. Web You must claim Maryland residency for the 2022 tax year.

How much money is the Maryland Student Loan Debt Relief Tax Credit. From some research I did. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the.

Going to college may. Your average tax rate is 2754 and your. Web The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC.

Web Eligible people have until Sept.

2022 Tax Credit The Deadline For Maryland Residents To Apply For Debt Relief On 1 000 In Student Loans Is In 18 Days Maryland News

What Is Maryland Student Loan Debt Relief Tax Credit Statanalytica

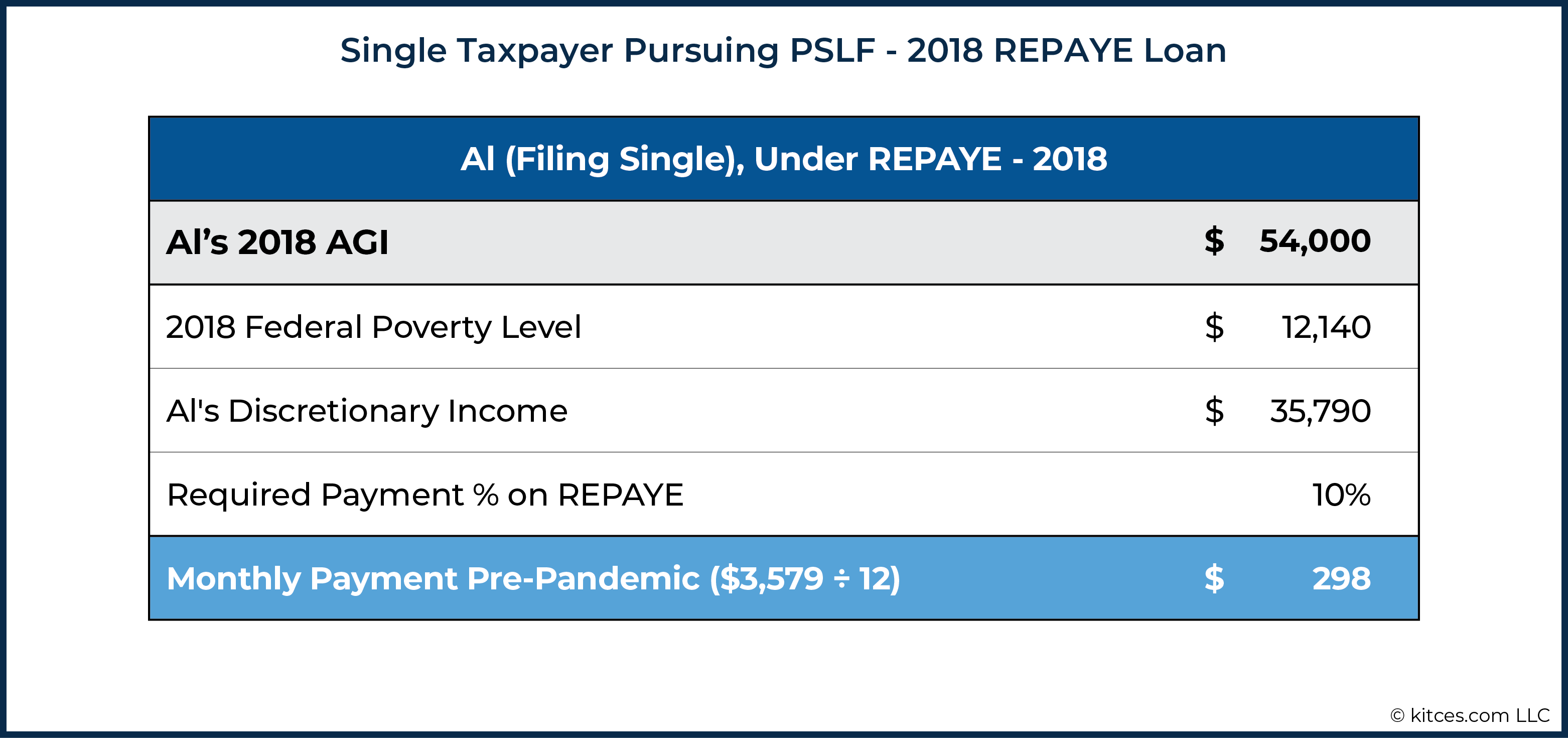

Income Recertification Planning As Student Loan Freezes Ends

Umd Students Have Mixed Feelings About Gov Hogan S Tax Credit For Student Loan Debt The Diamondback

Student Loan Debt Relief Remains On Hold But Could Forgiveness Wipe Out Your Tax Refund Cnet

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

9m In More Tax Credits Available For Maryland Student Loan Debt

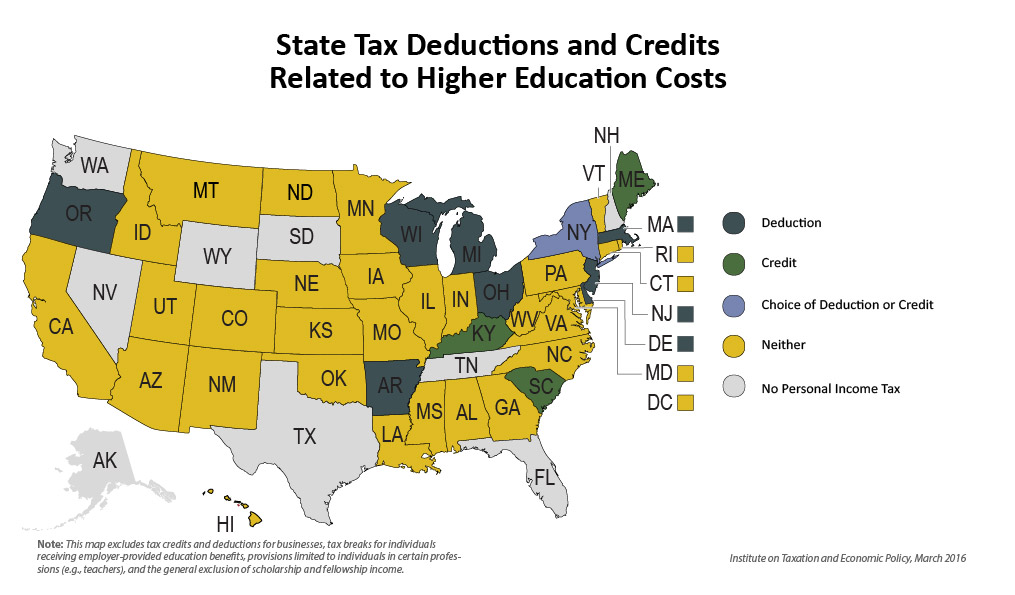

Higher Education Income Tax Deductions And Credits In The States Itep

Student Loan Debt 2022 Facts Statistics Nitro

Marylanders Can Apply For Some Relief From Student Loan Debt Wfmd Am

Scammy Student Loan Relief Calls Are Plaguing Borrowers Money

Tax Credits Deductions And Subtractions

Information On How To File Your Tax Credit From The Maryland Higher Education Commission

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Applications Available For 2018 Student Loan Debt Relief Tax Credit

Maryland Student Loan Debt Relief Tax Credit